If you already have solar (woo hoo!) – you got in before the solar Investment Tax Credit (ITC) steps down. But if you don’t…don’t worry! It’s not too late to claim your credit! Read on for more.

About the Solar Investment Tax Credit

The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000% – creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process.

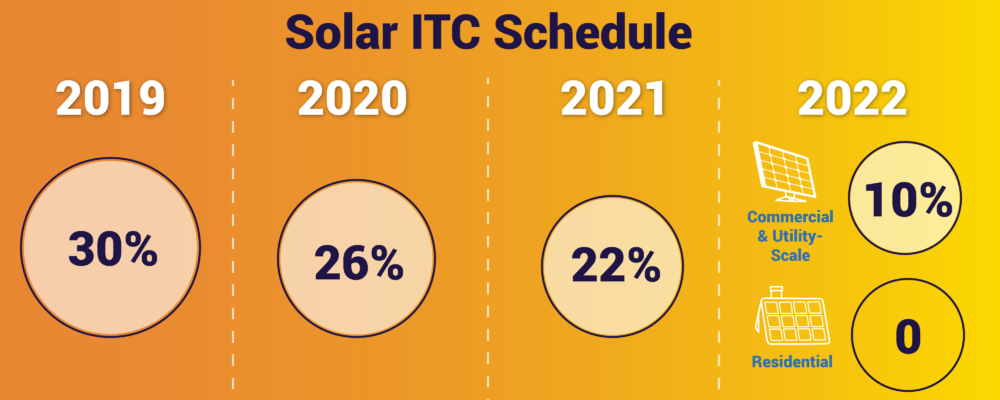

Although the industry is fighting to renew and extend this valuable policy for residential and commercial solar PV systems, as it stand the ITC is scheduled to step down as follows:

- 30% tax credit for projects that begin construction in 2019

- 26% tax credit for projects that begin construction in 2020

- 22% tax credit for projects that begin construction in 2021

- 10% tax credit for commercial projects starting in 2022.

- 2022 the ITC no longer exists for residential systems

Fortunately, the IRS has released much anticipated guidance (https://www.irs.gov/

These guidelines specify that as long as both payment is made and work starts before Dec 31, 2019, with continual progress being made until completion, projects still quality for the 30% ITC for 2019 even if the work is not completed before year end.

It’s been a great summer for solar, and our installation schedule is now full for the year – but don’t worry, it’s not too late! Contact us to take advantage of the full ITC in 2019 before the step-down takes place. Book your free solar site survey today!

BOOK YOUR FREE SOLAR SITE SURVEY

EVAN LEONARD

VICE-PRESIDENT