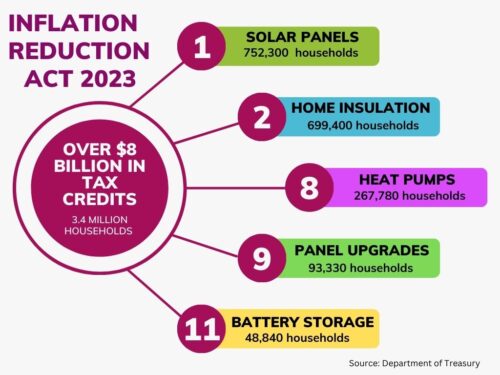

You may have seen news about the recent report released by the Department of the Treasury, detailing data from the Internal Revenue Service regarding the Inflation Reduction Act (IRA). The results are impressive, with solar energy leading the way, and give us great hope that we are moving in a positive direction for renewable energy.

The IRA went into effect in 2022, which makes 2023 the first full year its generous tax benefits can be studied. The IRA tax credits help residential households invest in clean energy (such as solar and battery power) and home energy efficiency (ranging from heat pumps to new windows).

More than $8 billion in tax credits went to 3.4 million households in 2023, with solar panels in the number one position on the most popular tax credit use chart. 752,300 American households received a 30% tax break on their solar system installations last year, and that number doesn’t include late returns!

- Solar energy accounted for the largest number of residential clean energy credit claims nationwide

- Washington ranks in the top 20 states benefitting from the IRA, with 18,540 households receiving the residential clean energy tax credit

- The clean energy credit value totals $6.3 billion dollars nationwide

We’d love to tell you that you have plenty of time to take advantage of the 2024 tax credits, or that the IRA benefits will be here for many years to come. Unfortunately, that’s not the case. As Politico points out, the IRA’s future may be affected by this year’s presidential election.

And, you only have a little bit of time left to get on the schedule for a solar installation or battery backup this year. We are currently booking for Fall, and there’s limited space available.

Bottom line: if you’ve been thinking about going solar or adding battery storage to your home, and want to get in on the 2024 tax breaks, do not delay.