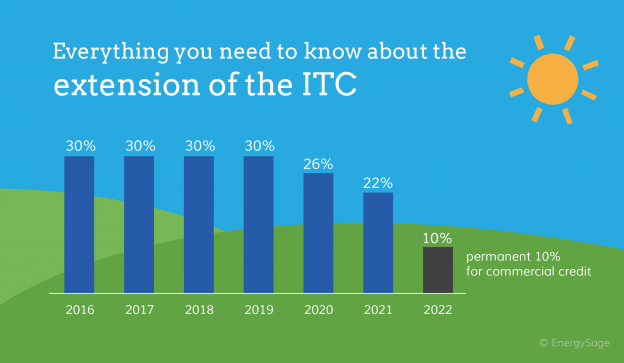

Time is ticking! The Federal Solar Investment Tax Credit (ITC) is set to step down Dec 31, 2020.

What is the Solar ITC?

The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value. In December 2015, Congress acted to extend the 30% tax credit through 2019 with a step down in subsequent years: to 26% in 2020, to 22% in 2021, and thereafter it is 0 (zero) for homeowners and 10% for businesses.

How Does The Solar Investment Tax Credit Work?

The Investment Tax Credit (ITC) is currently a 26 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit. A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income, Solar-Estimate has a tax incentive calculator and additional detailed information.

The ITC steps down Dec 31, 2020 and disappears completely for residential solar installations in 2022.

Don’t wait, schedule your free solar site survey today and let us help you take advantage of this valuable opportunity before it’s gone!

Book Your Free Solar Site Survey