Which solar incentives end in 2021? You may have heard “time is running out” to claim your solar incentives ending in 2021. What does this mean? Is time running out? The short answer:yes and no! All of the current Washington State solar incentives in place during 2021, continue into 2022. However, the Solar ITC steps down in 2023. For more information keep reading.

FEDERAL INCOME TAX CREDIT

The Solar Investment Tax Credit (“ITC”) is a federal tax credit for solar systems placed on residential (under Section 25D) and commercial (under Section 48) properties.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What is the federal solar tax credit?

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system. The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes “placed in service,” but the IRS has equated it with completed installation.

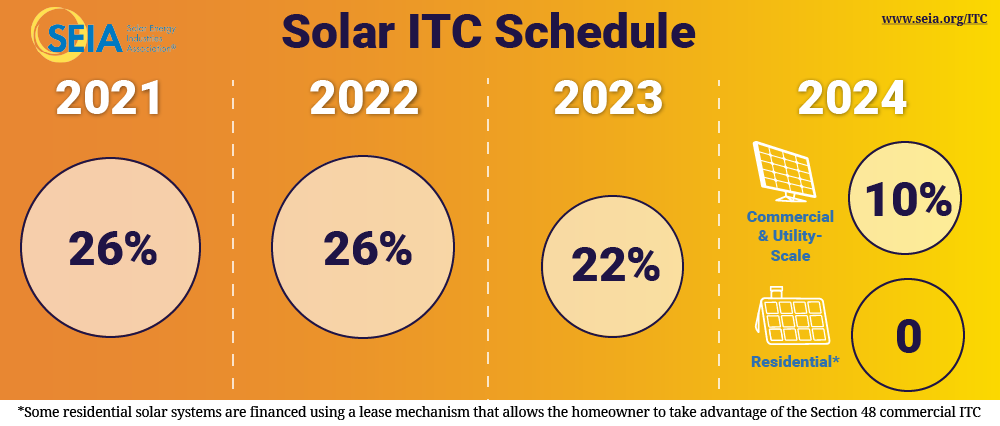

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit.) The tax credit expires starting in 2024 unless Congress renews it.

Which solar incentives end in 2021? The solar ITC steps down to 22% in 2023, but remains at 26% in 2022.

There is no maximum amount that can be claimed.

The Modified Accelerated Cost Recovery System (MACRS)

For businesses that go solar, this is a method of depreciation for some tangible property for tax purposes. Qualifying solar energy equipment is eligible for a cost recovery period of five years. The market certainty provided by MACRS has been found to be a significant driver of private investment for the solar industry and other energy industries. For equipment on which an Investment Tax Credit (ITC) or a 1603 Treasury Program grant is claimed, the owner may reduce the project’s depreciable basis by one-half the value of the 30% ITC. This means the owner is able to deduct 85 percent of his or her tax basis. The amount of the project cost that is eligible for a Bonus Depreciation is based upon the year of installation described above.

NET METERING

(Updated May 2019): The 2019 Washington State Legislature updated Washington State’s solar net metering statute via E2SSB 5223. In summary, an electric utility must offer to continue to make net metering available to eligible customer-generators on a first-come, first-served basis until the earlier of either June 30, 2029; or the first date upon which the cumulative generating capacity of net metering systems equals 4 percent of the utility’s peak demand during 1996. Click to read the summary. Click to read the full text of the legislation.

Net metering allows grid-connected renewable energy system owners to receive credit for excess electricity produced by their system. Net-metered systems that produce more electricity than needed are credited for the excess production at retail electric rates on the next month’s utility bill. Credits carry forward month to month but NOT year to year. Credits zero out on March 31 and a new net metering year begins. Therefore annually, a customer does not earn credits for more energy than they use that year. Monthly minimums or basic fees are not offset by net metering credits; credits offset per kilowatt-hour usage. Get more information.

- Link to the law governing this incentive.

- Visit your utility’s website and search on “net metering” to learn about their specific requirements for interconnection to their grid and net metering.

SALES TAX EXEMPTION

Starts July 1, 2019 for system sizes under 100 KW. Different rules apply for systems 100 KW to 500 KW. Sales tax exemption will continue through December 31, 2029. Click to the bill report as passed during the 2019 legislative session.

(Update 6/21/2019): The Washington State Department of Revenue has released a special notice containing information and instructions concerning the sales and use tax exemption on purchases and installation of solar energy systems. Click for details. Additional background information is available at the DoR’s 2019 Tax Legislation page.

LOCAL INCENTIVES FOR ENERGY EFFICIENCY

Many utilities offer incentives and rebates for energy efficiency upgrades that help their customers reduce their use of electricity. Review a comprehensive list of PUDs and utilities in Washington state. Check your utility’s website to find out what they have to offer.

WHICH SOLAR INCENTIVES END IN 2021?

While all of the current solar incentives in 2021 are extended to 2022, the Solar ITC is set to step down in 2023. There’s still time to take advantage of these valuable solar incentives.

For more information contact our solar experts today: